Global fintech firms are racing to enter the Asia-Pacific market, lured by high growth potential, expanding digital ecosystems, and a vast population needing financial inclusion. As the region solidifies its position as a fintech hub, it offers not only opportunities but also new challenges that reshape global financial markets.

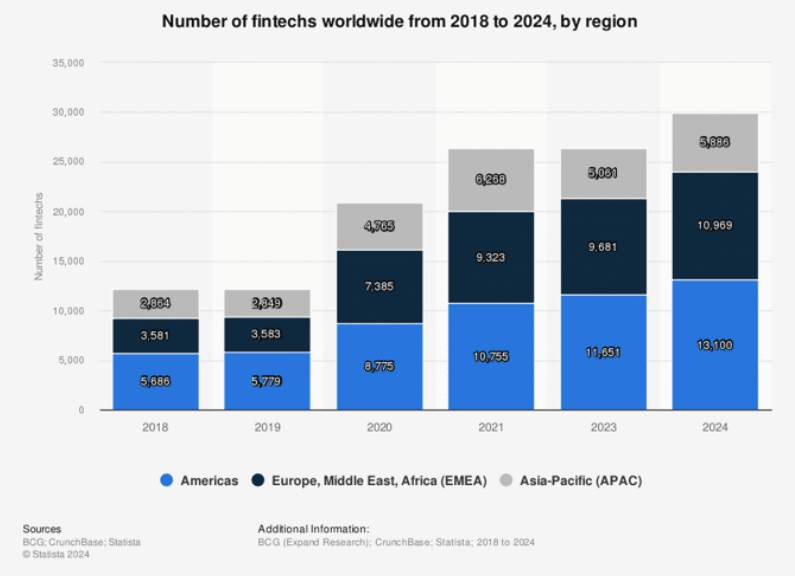

From data compiled by Statista, the global number of fintech companies currently stands at 29,955, with 5,886 of these companies, or approximately 19.6%, located in the Asia-Pacific region as of 2024. Asia-Pacific has witnessed an average annual fintech growth rate of 24% over the past five years, reflecting its rising influence. Despite this, most of the world’s fintech companies remain concentrated in the Americas and Europe.

Transaction Value Growth in Asia-Pacific Surpasses Global Peers

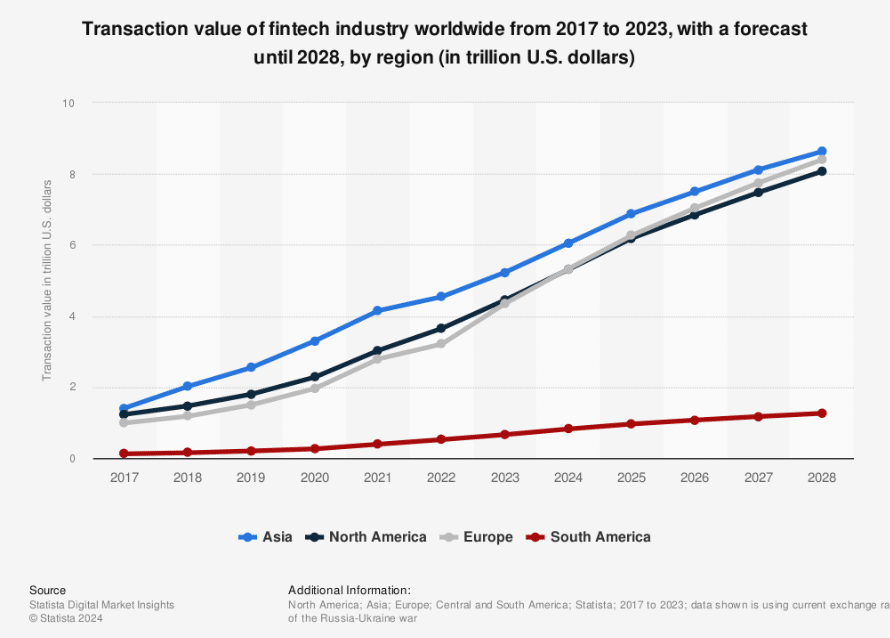

Although Asia-Pacific is not yet the dominant region in terms of fintech numbers, its transaction value has consistently surpassed other regions, including Europe, North America, and South Africa. Over the last decade, the transaction value in Asia has grown at an average rate of 18.4% annually, with the total transaction value in 2024 projected to reach USD 6.05 trillion. This upward trend is anticipated to continue, potentially positioning Asia as a global leader by 2028.

Asia-Pacific’s bright economic outlook continues to bolster the region’s attractiveness for investment. According to the latest International Monetary Fund (IMF) projections, Asia-Pacific’s GDP growth is set to reach 4.5% in 2024, outperforming the global growth projection of 3.2% for the same period. Emerging markets and developing economies (EMDEs) in Asia-Pacific are expected to see a robust 5.2% growth, with advanced economies in the region projected to grow by 1.6%.

Krishna Srinivasan, Director of the IMF’s Asia-Pacific Department, has noted that “Asia-Pacific economies remain the world’s most dynamic region, contributing approximately 60% to global growth by 2024.”

Global Fintech Investment Challenges in 2024

Despite the positive economic outlook, the global fintech industry is grappling with challenges in 2024. Geopolitical uncertainties and sustained high interest rates have led to a 16.8% decline in global fintech investments, from USD 62.3 billion in late 2023 to USD 51.9 billion in early 2024. This marks the lowest level of global fintech investment since early 2020.

The decline has affected all regions, including Asia-Pacific. In the first half of 2024, fintech investment in Asia-Pacific fell to USD 3.7 billion from USD 4.6 billion in the same period of 2023. This shift reflects an evolving investor mindset, increasingly favoring strong business models over rapid, unsustainable growth.

The ongoing high interest rate environment has made capital more expensive, contributing to a more selective investment climate. Investors focus on companies demonstrating clear profitability paths rather than pursuing high-risk ventures. Economic uncertainties, including fears of recession and geopolitical tensions, have further dampened investor sentiment across all regions, particularly affecting large-deal transactions.

Looking ahead into the second half of 2024, fintech investment is expected to remain subdued due to the persistent high cost of capital and ongoing geopolitical uncertainty. However, there is some optimism regarding the deal volume as early-stage investments continue to thrive amid this cautious market environment.

Continued Investor Interest Amid a Decline in Total Investment

Despite the overall investment decline, the Asia-Pacific fintech sector remains a focal point for investors. The number of deals increased from 406 in the latter half of 2023 to 438 in the first half of 2024. This rise in deal volume underscores the region’s enduring attractiveness, even as the total investment amount has shrunk.

The slight increase in deal volume also suggests a steady interest in smaller, early-stage fintechs over large, high-risk investments. This shift in deal volume reflects investor caution and a focus on sustainable, lower-risk ventures, with many investors now prioritizing early-stage companies exploring innovative areas like AI and green fintech over large, capital-intensive projects.

According to KPMG, some of the largest investments in Asia-Pacific during early 2024 included a USD 280 million investment in China-based financial services company Yi’an Enterprise, a USD 195 million investment in Thailand-based Ascend, and a USD 150 million infusion into Australian company Camms. This trend signifies a “flight to quality” within the APAC fintech landscape.

Rising M&A Activity in the Asia-Pacific Fintech Sector

Mergers and acquisitions (M&A) activity is also accelerating in Asia-Pacific. In 2022, the region recorded its highest fintech M&A value, totaling USD 33.9 billion across 129 deals. While M&A activity is more mature in markets like the United States and Europe, Asia-Pacific increasingly sees larger companies acquire fintech startups to enhance market share and drive innovation.

In subsequent years, the M&A landscape saw shifts influenced by economic uncertainties. By 2023, totaling USD 0.3 billion across 103 deals, investment values started to decline as rising interest rates and inflation caused investors to become more cautious. In the first half of 2024, M&A activity in Asia-Pacific further declined to USD 0.3 billion across 31 deals.

The fintech sector experienced a substantial valuation reset post-2022, following a peak in valuations driven by high pandemic-era demand for digital finance solutions. As valuations normalized, a gap emerged between what sellers expected and what buyers were willing to pay, leading to fewer large deals and a slowdown in M&A activity overall. Investors increasingly focused on smaller, early-stage investments or acquisitions with clearer paths to profitability.

Big opportunity for Fintech in Asia-Pacific

Asia-Pacific has rapidly evolved into a hub for innovative fintech startups, drawing investors eager to capitalize on growth opportunities in underserved markets. Estimates suggest that the region’s fintech market could reach USD 147.69 billion by 2024 and grow further at a compound annual growth rate (CAGR) of over 16%, potentially doubling by 2029.

Some projections even indicate a possible CAGR of 27%, which could make Asia-Pacific the largest fintech market globally by 2030. With its expansive ecosystem and substantial growth potential, the region is positioned to have a transformative impact on the global financial services landscape.

Several factors are driving this upward trajectory. One of them is supportive regulatory environments across many Asia-Pacific countries, which have fostered innovation. Governments are increasingly establishing regulatory sandboxes and implementing policies that encourage competition and the growth of fintech startups. This has created an enabling environment where new technologies can flourish and meet consumers’ diverse needs.

Home to 60% of the world’s population, Asia-Pacific also presents a unique advantage for the fintech industry. The sheer size of its unbanked and underbanked population provides an opportunity for fintech companies to address financial inclusion. By leveraging technologies such as digital payments, online credit platforms, and digital insurance, fintech companies can meet the needs of underserved communities.

Moreover, investment trends indicate a robust appetite for fintech across the region despite recent fluctuations in mergers and acquisitions. Venture capital and private equity continue to flow into fintech sectors, particularly in digital payments, insurtech, and blockchain technologies.

Indonesia Fintech Investment Trends

Indonesia is well-positioned as a key player in the Asia-Pacific fintech landscape due to its enormous market potential and ongoing digital transformation. The Indonesia Fintech Association (Aftect) noted the number of Indonesian fintech companies reached 336 in 2023, marking a remarkable seven-fold increase over previous years. This growth underscores Indonesia’s rapid evolution of the fintech sector.

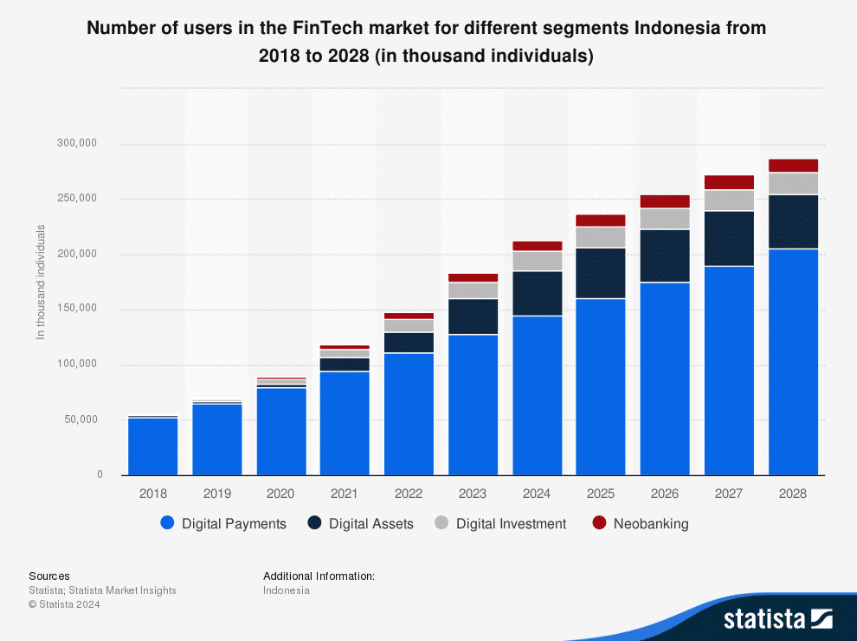

Indonesia’s fintech investment landscape is robust, with significant growth in fintech market users in all segments. According to Statista Research Department projections, Indonesia’s fintech users have continuously increased by an average of 18% annually in the last decade, from 2018 to 2028. In this regard, the Digital Payments segment achieves the highest value of 205 million users in 2028.

Fintech deals disclosed in Indonesia had a funding value of USD 0.77 billion in 2023. Gojek received a substantial amount of funding in 2021, the year with the highest investment levels. Xendit was the most well-funded fintech firm in Indonesia as of February 2024, having raised USD 538 million, followed by Akulaku, which raised USD 264 million. Other well-funded startups included Ajaib and Dana. These substantial investments have contributed to Indonesia’s emergence as a hub for fintech innovation, and it is now home to six fintech unicorns.

In the Indonesian fintech landscape, lending companies hold a central position, with 106 of the 336 registered fintech companies. The sector’s prominence is further underlined by its substantial share of investment, with alternative lending accounting for 84% of total fintech funding. As of March 2024, the country’s fintech lending market included 94 conventional and seven Sharia-compliant companies.

Investor Interest in Advanced Technologies

Investor interest in the Asia-Pacific fintech market continues to rise, spurred by the adoption of advanced technologies like artificial intelligence (AI) and machine learning (ML). These technologies improve operational efficiency and customer experiences, making fintech offerings more attractive. From credit risk assessment to AI-powered customer service chatbots, AI plays a crucial role in Asia-Pacific’s fintech evolution, with many companies using big data analytics to understand customer behavior better.

Integrating AI and ML technologies into financial services also contributes to the emergence of digital banks, particularly in countries with populations that traditional banking systems have underserved. This shift creates new opportunities for consumers to access previously unavailable financial services. Countries like Indonesia and the Philippines are seeing significant growth in this sector.

With its vast population, rapid technology adoption, and growing government support, Asia-Pacific is poised to become a powerhouse in the global fintech ecosystem. For founders and investors seeking sustainable and impactful investment opportunities, now is the time to engage. Connect with Skystar Capital to discover how you can be part of Asia-Pacific’s financial revolution.

At Skystar Capital, we take pride in being the first backers of visionaries. With deep local expertise and an extensive network in the Indonesian market, we are ready to support your innovative solutions to drive Indonesia forward. Submit your business proposal here!

Follow us on LinkedIn, YouTube, and Instagram for the latest updates!