SINGAPORE / JAKARTA, 4 February 2026 – Ledgerowl, an AI-powered accounting automation platform, today announced strategic funding from Skystar Capital and Incubate Fund Asia. The investment will fuel the company’s expansion in Australia, where it aims to transform how accounting firms and finance teams handle high-volume transaction processing and financial close management.

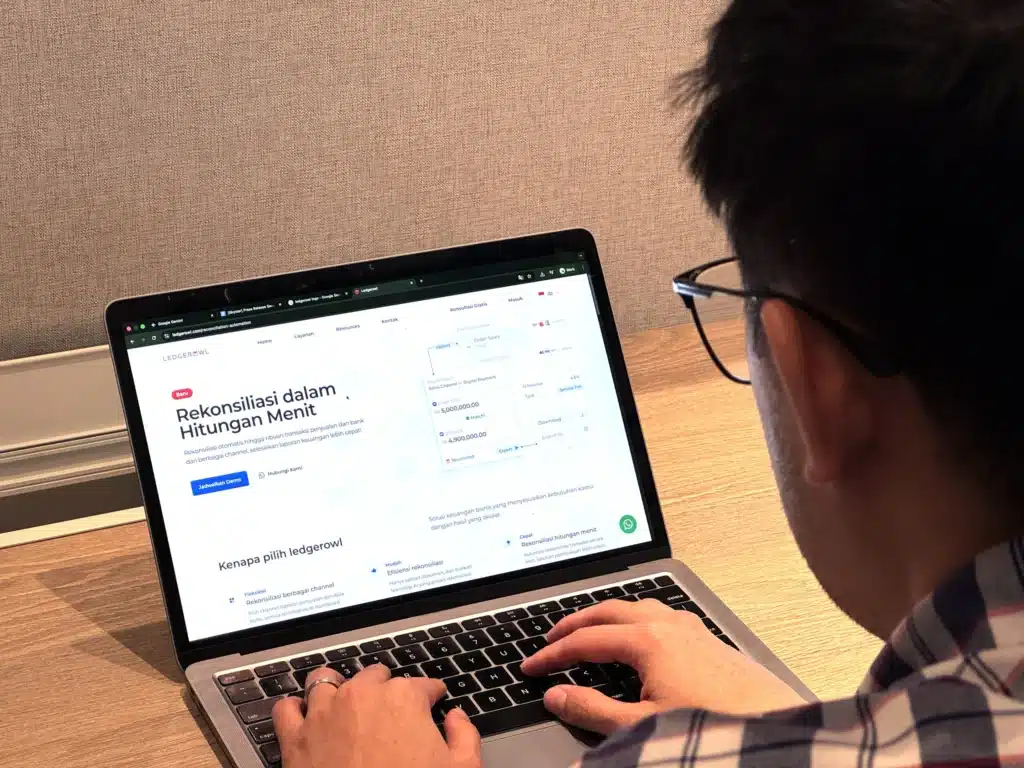

Founded by Australian-Indonesian entrepreneurs Rey Kamal and Adrian Yasin, Ledgerowl has developed a sophisticated platform that combines intelligent automation with professional accounting expertise. The solution addresses persistent inefficiencies in financial workflows, enabling businesses and accounting practices to reduce reconciliation cycles from days to minutes while maintaining audit-grade accuracy.

“Traditional accounting outsourcing has relied on labour arbitrage, sending work offshore to cut costs,” said Rey Kamal, Co-Founder and CEO of Ledgerowl. “We’re taking a fundamentally different approach by combining AI-powered automation with skilled accountants to deliver both efficiency and quality. Our clients don’t just save time; they gain confidence in their financial data and the strategic capacity to grow their businesses.”

The company has established a strong operational track record, serving high-growth clients across food and beverage, retail, and property sectors. Ledgerowl has experienced 15x growth since its inception, now processing over one million transactions annually, just from reconciliation products alone. The platform is currently helping clients across industries, reducing their monthly financial close cycles by up to 74%.

Adrian Yasin, Co-Founder and CTO of Ledgerowl added, “This investment allows us to accelerate our AI roadmap and fast-track our agentic AI initiatives, embedding intelligence directly into core accounting workflows to deliver faster closes, higher accuracy, and continuously improving outcomes for finance teams.”

Ledgerowl is entering the Australian market at a pivotal moment. Rising labour costs and persistent talent shortages have intensified demand for scalable accounting solutions, particularly among small-to-medium enterprises and regional accounting firms. However, traditional offshore models often struggle with quality control, communication barriers, and compliance complexity. Ledgerowl bridges this gap with a ‘human-in-the-loop’ AI model that delivers the cost efficiency of offshoring with the accuracy of local CAs and CPAs.

“What sets Ledgerowl apart is their operational discipline,” said Abraham Hidayat, Managing Partner at Skystar Capital. “They’ve built a technology platform that genuinely understands accounting workflows, not just data entry automation. Combined with their managed service delivery, this creates a solution that scales without sacrificing quality. That’s extremely difficult to replicate.”

Nao Murakami, Founder and General Partner at Incubate Fund Asia, added: “Since we believe AI can disrupt and upgrade the traditional accounting outsourcing business, we have been chasing investment opportunities around this thesis for 1-2 years in India and Southeast Asia. We are thrilled to support Ledgerowl’s talented team which has a hybrid background in accounting and tech – perfect for our thesis. With leveraging its ties with Australia and New Zealand, we strongly believe that Ledgerowl will become an AI enabled accounting powerhouse”.

Ledgerowl has already secured early partnerships with Australian accounting practices and SMEs, with several pilot programs underway in Sydney and Melbourne.

The company previously raised pre-seed funding in 2023 from Init6, founded by Bukalapak co-founder Achmad Zaky, and Sydney-based venture capital firm Investible, demonstrating consistent investor confidence in its vision and execution.

About Ledgerowl

Ledgerowl is an AI-powered accounting platform that automates complex financial workflows including transaction reconciliation, accounts payable/receivable, and month-end close processes. By combining intelligent software with managed accounting services, Ledgerowl enables businesses and accounting firms to achieve operational excellence without expanding headcount. Headquartered in Singapore, the company serves clients across Indonesia and is expanding in Australia.

Website: https://ledgerowl.com

About Skystar Capital

Skystar Capital is an early-stage venture capital firm investing in technology companies across Southeast Asia. The firm partners with founders building scalable solutions in Artificial Intelligence (AI), ESG, B2B software, and digital infrastructure.

About Incubate Fund Asia

Incubate Fund Asia, originating from Japan, is a renowned venture capital fund specializing in seed-stage investments. With a history of nurturing over 200 startups in Japan and Asian regions, they expanded to India in 2016. They actively engage with startups, offering hands-on support and mentorship, making them a vital partner for entrepreneurs..

To know more- https://www.incubatefund.in/

Media Contact

Christopher Josua

Head of Communication and Partnerships, Skystar Capital

📧christopher@skystarcapital.com | 📞 +62817613011