Fundraising in Southeast Asia’s fintech sector is notoriously difficult, largely due to the complex regulatory landscape (Legal Business Online, 2023). Hiro Kiga, Co-Founder of Wallex, a B2B cross-border payment platform, is no stranger to these challenges.

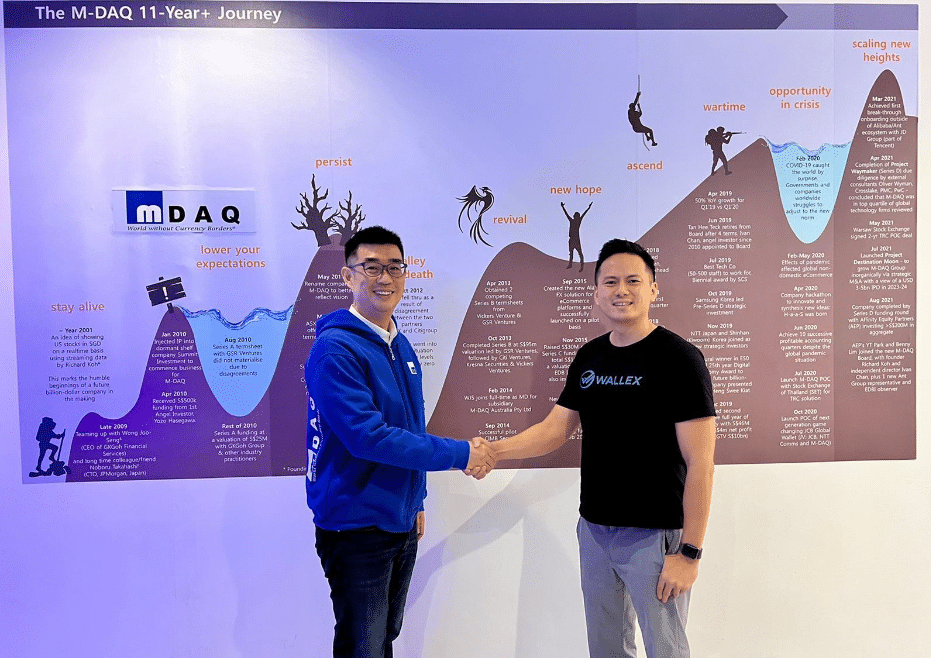

Founded in 2015 by Hiro and Jody Ong, Wallex successfully raised three rounds of funding: seed in 2016, pre-series A in 2018, and series A in 2020. The company was later acquired by fintech firm M-DAQ in 2022. To date, Wallex has facilitated over US$27 billion in cross-border transactions for 35,000 businesses in Indonesia, Malaysia, Singapore, and Hong Kong.

As a former venture capitalist himself, Hiro now shares his fundraising journey with Skystar Capital, offering practical advice for fintech founders navigating today’s challenging fundraising landscape.

Wallex’s fundraising journey from seed to Series A

Wallex did not go through a bootstrapping phase; instead, the company began fundraising with zero product and only started building the business after securing seed funding. “We were pitching about Wallex’s business before we started building it because we had to really focus on the license application in the very beginning, and we needed capital for that,” Hiro explains.

But getting funding for a fintech business without a license isn’t easy, even for someone who came from a VC background like Hiro. “80% of VCs passed on our seed and pre-series A rounds because we didn’t have a license,” he recalls.

Hiro believes that fundraising pre-product is still achievable, even in today’s challenging landscape. He emphasizes that founders with either senior-level experience in their industry or a proven track record in entrepreneurship have a better chance of securing investment early on.

In 2016, Wallex raised its seed round from Amand Ventures, which allowed the company to apply for a regulatory license and begin exploring product-market fit (PMF). At this stage, Wallex focused on activities that did not require full licensing, such as using first-party foreign exchange services.

Despite gaining traction through these limited activities, Wallex still faced fundraising difficulties due to the lack of a business license. The pre-series A round, led by Beenext in 2018, provided additional runway as Wallex waited for its business license, which took far longer than expected.

By the time Wallex raised its Series A funding in 2020, the product had already achieved PMF. However, at this stage, investors expected more than just validation of the business model—they needed to see that the company could scale. “So unless that is clear, or unless you have some initial sort of traction in that second, third engine of growth, these days it’s going to be very difficult for Series A,” Hiro explains. For Wallex, demonstrating this meant expanding into new markets like Malaysia and Hong Kong.

The Series A round, led by BAce Capital and with participation from investors such as Skystar Capital, provided the funding necessary for Wallex to scale its operations. This success eventually led to the company’s acquisition by fintech firm M-DAQ in 2022, marking a successful exit for its investors.

Wallex’s fundraising playbook

Navigating the fundraising process requires preparation, strategy, and understanding of the VC landscape. In this conversation, Hiro also shares his playbook for founders looking to secure investment and build meaningful relationships with venture capitalists:

1. Do your homework and identify the right VCs

The first step in fundraising is identifying the right VCs for your startup. Hiro emphasizes the importance of thorough research. This means finding VCs that are open to financing your startup based on your funding round, sector, and market.

For fintech startups, it’s essential to identify investors with a proven interest in the space. You can gather this information through online research, industry reports, and platforms like Crunchbase or Tracxn.

2. Vet VCs through portfolio founders and assess their expertise

Fundraising is a two-way street, and startups should carefully vet VCs to ensure a strong, lasting partnership.

When evaluating VCs, it’s important to look beyond their successes and focus on how they handle difficult situations with their portfolio companies. “Talk to founders whose companies are struggling because, at some point, your startup will face challenges. You need to understand how the VCs will support you during tough times,” Hiro advises.

This approach ensures that you’re choosing investors who will stand by you during difficulties, rather than only supporting you when the company is thriving.

Additionally, it’s important to check whether they truly understand your sector.

“You’ll know if they understand fintech based on whether they ask generic questions or if they know the specifics of being a fintech operator,” Hiro says.

This insight can help you distinguish between priority VCs—those who offer real value—and practice VCs, who you can use to refine your pitch.

3. Get warm introductions—cold emails don’t work

“The majority of the time, companies that end up becoming portfolio companies are those that come through referrals or intros from existing founders,” Hiro shares. “Referrals work best because it already brings a level of trust.”

He advises founders to leverage their networks to get connected with VCs, especially through introductions from other founders. “You’ll find that many founders are quite helpful in giving feedback or even making intros,” he adds. It’s a small community, and these connections can make all the difference when trying to stand out to investors.

4. Pitch to non-priority VCs first to refine your approach

A key element of Hiro’s fundraising strategy is scheduling the pitch sessions in a way that allows you to refine your pitch as you go. “You should pitch to the non-priority VCs first, get their thoughts and feedback, and then adjust your pitch for the priority VCs,” Hiro says. This method allows founders to improve their presentations and respond to potential concerns before approaching high-priority VCs.

“We spoke to 40 to 50 VCs over the course of two weeks for each of our funding rounds,” Hiro recalls, emphasizing how the fast pace helped Wallex build momentum and receive quick feedback. He notes that BAce Capital was the 42nd VC they pitched to, highlighting the importance of resilience in the fundraising process.

5. Be adaptable with your pitch and valuation

Flexibility is key when refining your pitch. Hiro notes that founders should be open to changing their pitch based on feedback, especially after the initial rounds of meetings.

“You can adjust your pitch along the way,” Hiro suggests. For example, if VCs think your valuation is too high, you can offer discounts to priority VCs to close the deal. Adapting your approach based on feedback can significantly improve your chances of securing funding.

6. Push for a clear decision

Hiro stresses the importance of getting a firm decision from VCs, whether it’s a yes or no. He notes that there are signs to watch for when a VC isn’t interested. “If they’re not following up from their side, just leave it at that,” Hiro explains. This approach prevents the process from dragging on and gives you clarity on where you stand with each investor.

7. Consider raising with SAFE or convertible notes

To streamline the fundraising process, Hiro recommends raising funds using SAFE notes or convertible notes. “With SAFE notes or convertible notes, it’s quicker and administratively easier than equity rounds,” Hiro explains. This strategy allows founders to secure funding quickly, ensuring they have the capital they need to keep their operations running while continuing to raise the rest of the round.

8. Keep VCs engaged with regular updates

After the pitching process or even after securing funding, maintaining relationships with VCs is critical. Hiro emphasizes the importance of sending regular updates to keep investors informed of your progress. “In our case, we sent quarterly updates,” Hiro says.

Regular communication helps keep VCs engaged and shows them how the business is evolving. It also allows you to gauge which VCs are truly interested in your company based on their responsiveness to these updates.

Why Skystar Capital invested in Wallex

Fundraising is often marked by multiple rejections. According to Hiro, some VCs who decline in earlier rounds will likely continue to say no in future pitches. However, in his experience, Skystar Capital was the one exception, eventually coming through with a yes.

Initially, Skystar Capital had concerns about Wallex’s lack of a business license, which led them to pass on an earlier round. However, once Wallex secured the license, Skystar Capital made the decision to invest.

“We’ve been following Wallex’s journey for quite a while and were excited to hear that they had secured a crucial component for any fintech business—a business license,” says Geraldine Oetama, Partner at Skystar Capital. “We made the decision to invest, not only because we believe in the fintech space, but also because we understand Wallex intimately, as our partner is a frequent user. This familiarity gave us confidence in their potential and commitment to scale.”

By investing in Wallex, Skystar Capital saw an opportunity not only to support a promising startup but also to actively contribute to its growth. “Our goal wasn’t just to invest capital but to bring value by opening doors and making introductions that would help Wallex scale,” she concludes.

At Skystar Capital, we take pride in being the first backers of visionaries. With deep local expertise and an extensive network in the Indonesian market, we are ready to support your innovative solutions to drive Indonesia forward. Submit your business proposal here!

Follow us on LinkedIn, YouTube, and Instagram for the latest updates!