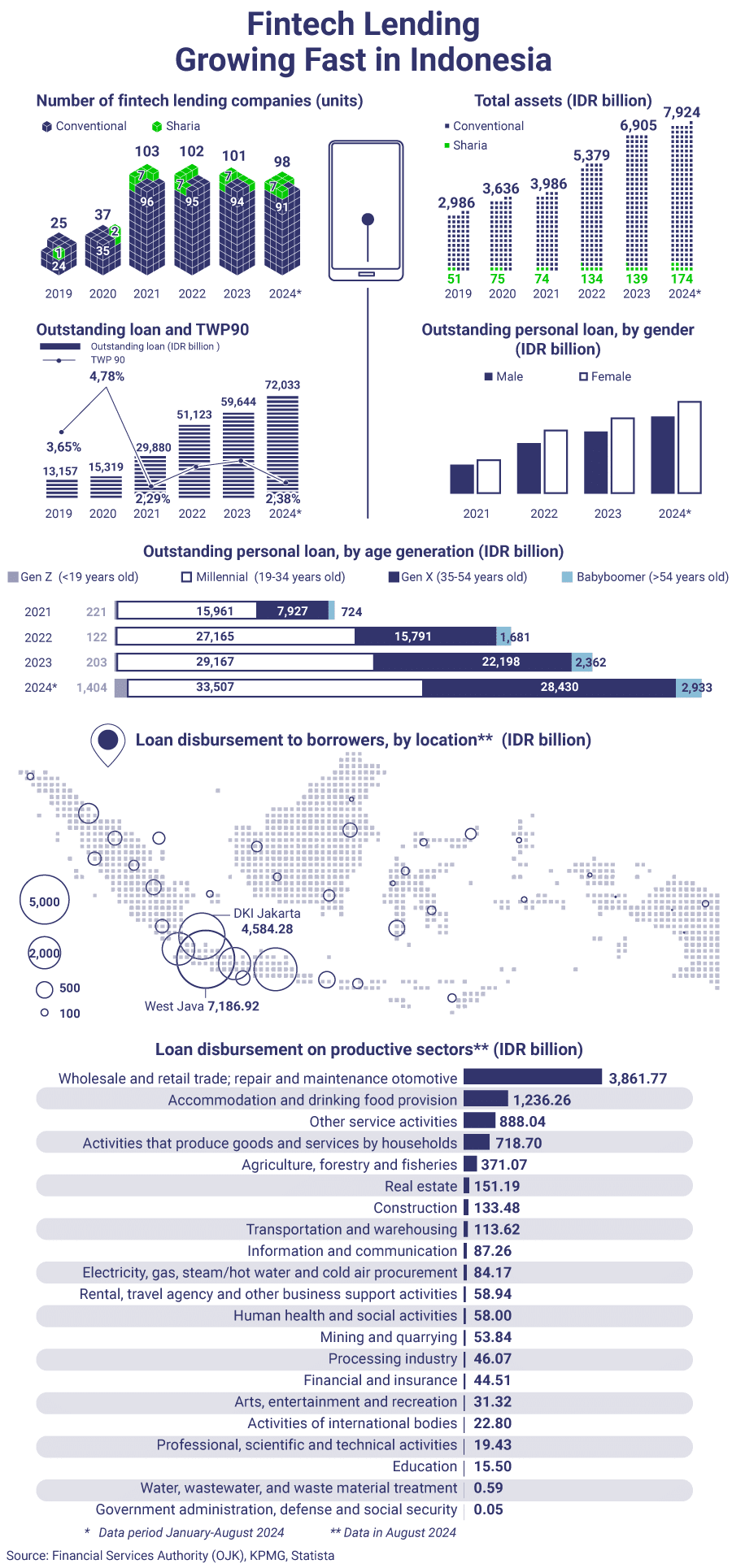

Fintech lending in Indonesia has experienced remarkable growth in recent years, with an annual increase in assets of up to 22%. The rapid growth of fintech lending is driven by various factors, such as the high demand for accessible financing, significant advances in digital technology, and a regulatory framework that encourages innovation and consumer protection.

Indonesia’s significant unbanked population—especially in rural areas—creates an opportunity for fintech lending to continue to grow. By 2024, the number of fintech lending companies will increase fourfold compared to five years ago. Fintech lending has succeeded in presenting an attractive alternative by facilitating faster and more accessible credit solutions for individuals and small businesses that have struggled to gain access to banks.

The demand for fintech lending services is also large, with outstanding loans continuing to increase. Borrower demographics are almost balanced between men and women. Borrowers are dominated by the productive age of the millennial generation (19-34 years old) and the X generation (35-54 years old). This shows the success of various Financial Services Authority (OJK) regulations to ensure fintech lending is safe and secure.

Indonesia’s fintech lending market is expected to grow, and technological advances and high demand from MSMEs and individual borrowers support it. However, the expansion of the fintech lending industry remains dependent on efforts to establish responsible lending practices and a regulatory framework that balances growth with borrower protection.

Check the infographic below!

The infographic research is a collaboration between Skystar Capital and the Research and Development team of Harian Kompas